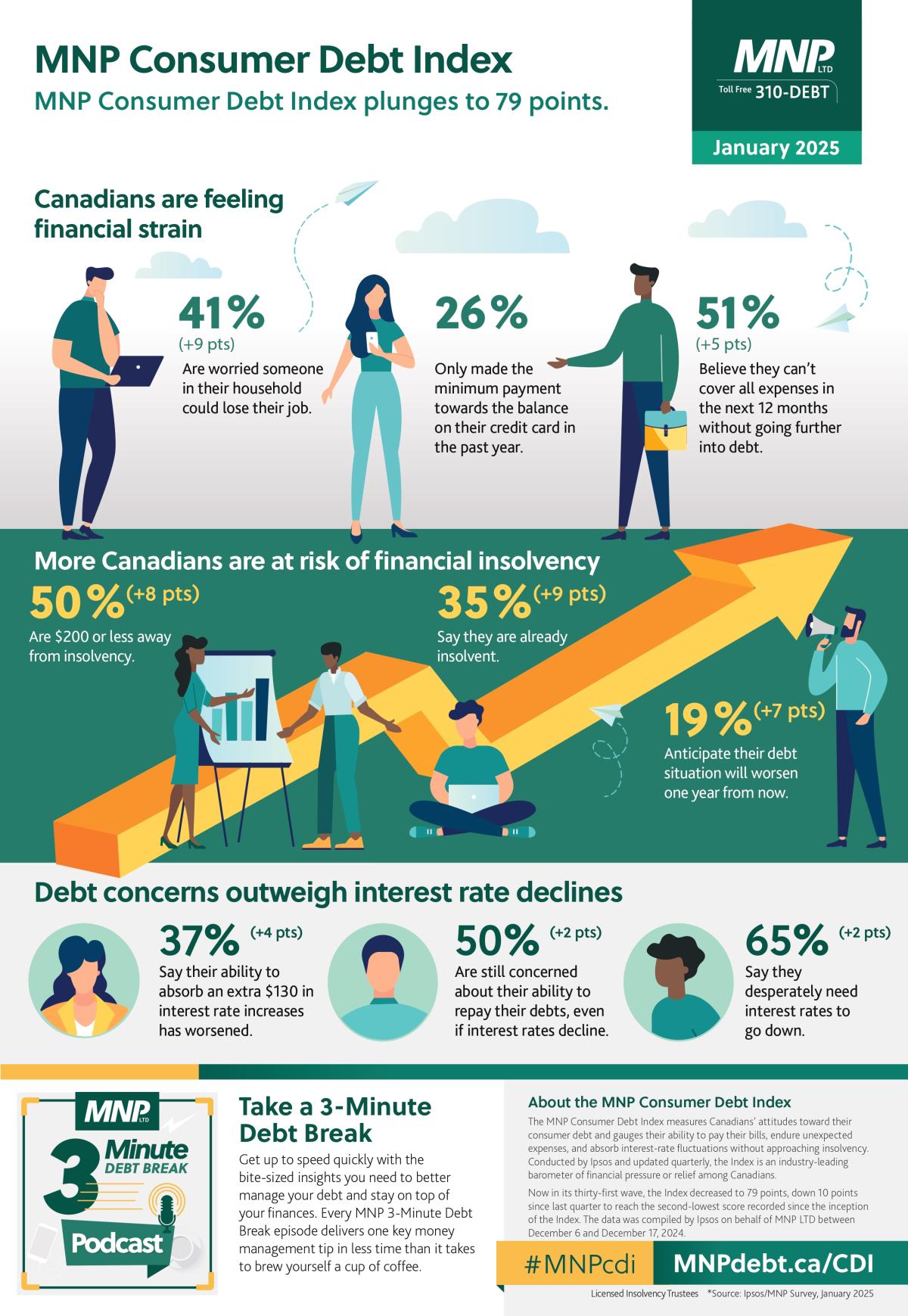

CALGARY, Alberta, Jan. 13, 2025 (GLOBE NEWSWIRE) — Canadians are heading into the New Year feeling more pessimistic about their personal finances, despite declining interest rates. The latest MNP Consumer Debt Index, conducted quarterly by Ipsos, dropped a staggering 10 points to 79 points, marking the second-lowest level on record since the Index’s inception in 2017. Canadians’ personal debt rating has plunged to an all-time low, marking a sharp 12-point decline from the previous quarter. The only other time personal debt rating reached close to this low point was in December 2022.

“While interest rate cuts last year provided some initial relief from their financial worries, Canadians are starting the New Year with holiday bills arriving and a more pessimistic view of their finances,” says Grant Bazian, president of MNP LTD, the country’s largest insolvency firm.

Economic uncertainty is reflected in Canadians’ pessimistic outlook on their financial future. Fewer Canadians this quarter expect their debt situation to improve one year from now (27%, -4pts), while a growing number anticipate it will worsen (19%, +7pts). Alongside this, job anxiety has reached an all-time high, with two in five (41%, +9pts) worried someone in their household could lose their job. Moreover, half of Canadians (51%, +5pts) believe they will not be able to cover all of their living and family expenses in the next 12 months without going further into debt.

There was a sharp increase in the number of Canadians teetering on the edge of financial insolvency compared to last quarter, with half (50%, +8pts) now indicating they are $200 or less away from not being able to pay their bills and debt payments each month, a significant eight-point increase since last quarter. One-third say they are already insolvent (35%, +9pts), jumping nine points. Women (55%, +4pts) are more likely than men (44%, +13pts) to be $200 or less away from insolvency, although the jump among men this quarter was particularly striking, increasing 13 points.

“Many Canadians are already tightening their finances, reassessing budgets, and exploring cost-cutting measures to manage rising living costs or debt repayment. Unfortunately, in some cases, even substantial sacrifices may fall short of providing meaningful financial relief even in the lower interest rate environment,” says Bazian.

Despite consecutive interest rate cuts in 2024, Canadians’ attitudes towards their finances and interest rates have worsened this quarter. Half of Canadians (50%, +2pts) are still concerned about their ability to repay their debts, even if interest rates decline. Nearly half (46%, +4pts) are concerned that rising interest rates could move them towards bankruptcy, while two-thirds (65%, +2pts) say they desperately need interest rates to go down.

In line with these concerns, the financial cushion for many households is eroding as disposable income shrinks, leaving less room to manage unexpected expenses. This quarter, Canadians have on average $147 less left over at the end of the month, decreasing to $790.

“Less wiggle room leaves households vulnerable to unexpected expenses or the impacts of economic changes,” explains Bazian. “For those already living paycheck to paycheck, any financial disruption could quickly escalate into a crisis.”

As financial pressures mount, Canadians’ ability to absorb an extra $130 in interest rate increases has deteriorated. Fewer Canadians this quarter (17%, -5pts) feel much better equipped to handle such an increase than they used to be, while more (37%, +4pts) report being much worse off. The possibility of unexpected expenses or life changes also weighs heavily on Canadians, with one-third (33%, +7pts) expressing a lack of confidence in their ability to cope with an unexpected auto repair or purchase, and nearly two in five (38%, +6pts) indicating they are not confident in their ability to cope with a job loss or change in wages or seasonal work.

Bazian says the convergence of post-holiday bills, economic pressures and unexpected expenses can exacerbate financial challenges. While the New Year is traditionally a time for setting financial goals, some Canadians will find themselves grappling with the financial fallout of holiday spending, creating an urgency to seek support and address debt concerns early in the New Year.

Seeking advice from a Licensed Insolvency Trustee is a critical first step for those feeling overwhelmed by debt. As Canada’s only federally regulated debt professionals, Licensed Insolvency Trustees provide free consultations to help individuals assess their financial situation, understand their options, and create customized plans to regain control of their finances.

“For many, this time of year can feel overwhelming as the holiday bills arrive and financial realities set in, but reaching out for expert advice can mark a critical turning point – an opportunity to regain control and avoid more severe financial consequences such as bankruptcy,” says Bazian. “That first conversation with a Licensed Insolvency Trustee can help them explore solutions such as budgeting, debt consolidation, debt management plans, consumer proposals, and in some cases, bankruptcy.”

MNP’s extensive network of Licensed Insolvency Trustees provides free consultations in over 200 offices nationwide, delivering local, personalized support to help Canadians navigate their debt options.

About MNP LTD

MNP LTD, a division of the national accounting firm MNP LLP, is the largest insolvency practice in Canada. For more than 50 years, our experienced team of Licensed Insolvency Trustees and advisors have been working with individuals to help them recover from times of financial distress and regain control of their finances. With more than 240 Canadian offices from coast-to-coast, MNP helps thousands of Canadians each year who are struggling with an overwhelming amount of debt. Visit MNPdebt.ca to contact a Licensed Insolvency Trustee or use our free Do it Yourself (DIY) debt assessment tools. For regular, bite-sized insights about debt and personal finances, subscribe to the MNP 3 Minute Debt Break Podcast.

About the MNP Consumer Debt Index

The MNP Consumer Debt Index measures Canadians’ attitudes toward their consumer debt and gauges their ability to pay their bills, endure unexpected expenses, and absorb interest-rate fluctuations without approaching insolvency. Conducted by Ipsos and updated quarterly, the Index is an industry-leading barometer of financial pressure or relief among Canadians.

Now in its 31st wave, the Index has decreased to 79 points, down 10 points since last quarter to reach the second-lowest score recorded since the inception of the index. Visit MNPdebt.ca/CDI to learn more.

The data was compiled by Ipsos on behalf of MNP LTD between December 6 – 17, 2024. For this survey, a sample of 2,003 Canadians aged 18 years and over was interviewed. Weighting was then employed to balance demographics to ensure that the sample’s composition reflects that of the adult population according to Census data and to provide results intended to approximate the sample universe. The precision of Ipsos online polls is measured using a credibility interval. In this case, the poll is accurate to within ±2.5 percentage points, 19 times out of 20, had all Canadian adults been polled. The credibility interval will be wider among subsets of the population. All sample surveys and polls may be subject to other sources of error, including, but not limited to coverage error, and measurement error.

Provincial data is available upon request.

CONTACT

Angela Joyce, Media Relations

e. [email protected]

A photo accompanying this announcement is available at