According to the Federal Reserve Bank of New York, auto loans are now the second-largest household debt in America, standing at $1.64 trillion, which is slightly higher than student loan debt at $1.6 trillion (but still way behind mortgage debt balances at $12.59 trillion).

Check Out: Suze Orman’s No. 1 Money Tip Is ‘Very, Very Different’ From Most Advice You Have Heard

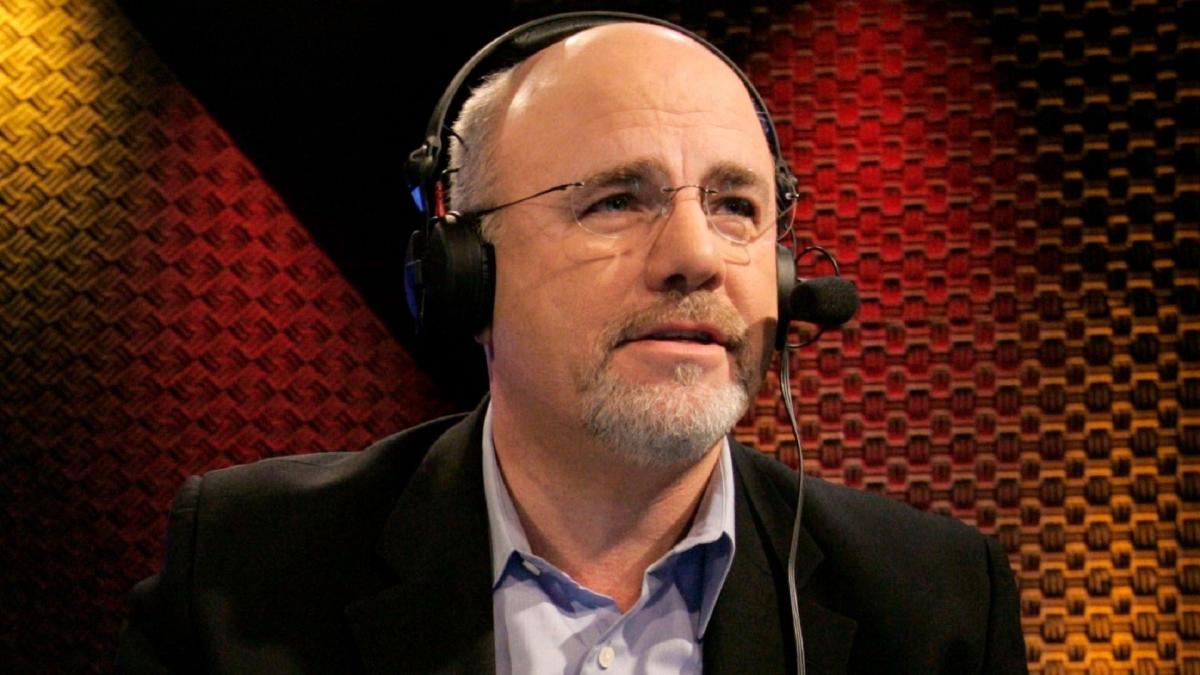

Learn More: 4 Secrets of the Truly Wealthy, According to Dave Ramsey

With monthly average car payments still so high — $734, $525 and $586 for new, used and leased vehicles, respectively, per LendingTree — it makes little sense to throw so much, or any, money at a depreciating asset and take on more debt.

That’s the thinking of the best-selling author, personal finance guru and radio program and podcast host, Dave Ramsey. He discusses why a monthly car payment is costing you millions of dollars and what you can do with that money instead.

Earning passive income doesn’t need to be difficult. You can start this week.

Ramsey is well-known for his straightforward approach to financial education and, as such, is dead against wasting money that can be better spent on building wealth through investment.

Posting a short video blast on X, formerly Twitter, at the beginning of November, Ramsey emphatically stated his case:

“And you scratch your head and wonder why you’re freaking broke!” he said. “The average car payment in America now is $499. That’s suspiciously like $500 bucks. If you take $500 a month and invest it from age 30 to age 70, you’ll have — would you believe it — you’re going to have over $5 million!”

Successful wealth builders don’t give money away to Ford’s and Toyota’s finance departments, and they certainly don’t spend decades making payments on a succession of cars. Instead, they grow their fortunes by investing their income.

We already know that many of the world’s wealthiest individuals choose to drive affordable, dependable cars that suit their needs over expensive, swanky toys. The average American with a net worth under seven figures should really only be buying used and with cash, per Ramsey.

“Going into debt to buy one is a horrible idea, so go ahead and take getting a car loan off the table,” states a Ramsey Solutions article from early 2024. “That means the car you can afford is the car you can pay cash for up front. Not only is it possible, it’s also the best way to by a car, hands down!”

Try This: Warren Buffett — 10 Things Poor People Waste Money On

By staying away from unnecessarily high financing and lease payments, you can invest any extra money into assets to build wealth through unrealized gains — any investment that has appreciated in value on paper but hasn’t been realized through a sale — which could potentially net you millions, depending on their value when they are sold.